Is Tesla's Cybercab the ticket to robotaxi profits for investors?

Your Weekly Shortcut to Deeptech Investing—Exclusive Trends & Startup Reports for VCs & Angels in Just 5 Minutes

In a flash: A game changer for investors? The launch of Tesla's Cybercab impacts investors in the autonomous vehicle market. Safety concerns and unclear plans have shaken confidence, leading to a drop in Tesla's stock, while competitors like Uber and Lyft saw gains. Investors should understand the broader landscape, including regulatory challenges and tech advancements. A diversified investment strategy focusing on various companies will be important for capitalising on future growth in this market.

What is happening?

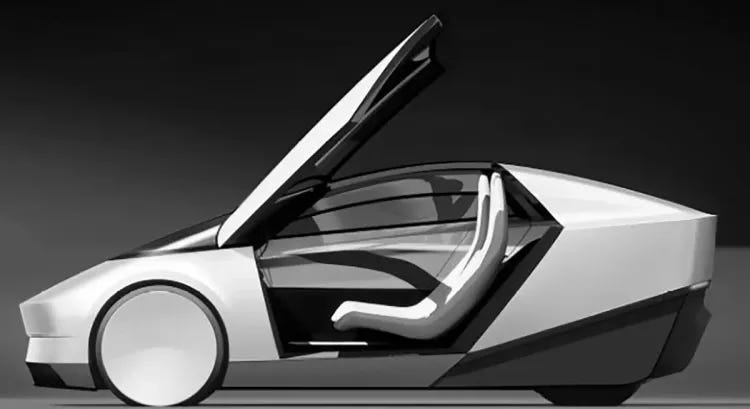

Tesla, a leading electric vehicle manufacturer, is expanding into the autonomous vehicle market with its Cybercab robotaxi. The company is leveraging its expertise in AI and electric vehicle technology to develop fully autonomous vehicles for the ride-hailing industry.

How will they make money?

Tesla plans to generate revenue through:

Direct sales of Cybercabs to individuals and fleet operators.

Running taxi services using its own fleet of autonomous vehicles.

Licensing their self-driving technology to other manufacturers.

What is the investment potential?

Recent Performance:

Tesla's stock fell 8% after showing the Cybercab1.

The company lost $60 billion in value after the announcement.

Future Projections:

The global robotaxi market is estimated to reach $2.2 trillion by 20302.

Tesla aims to begin Cybercab production before 2027.

The company projects each ride will cost about $0.40 per mile.

Risk Factors:

Unclear when Cybercabs will be ready and approved.

Intense market competition from companies like Uber, Waymo, and Cruise.

Regulatory rules might slow down autonomous vehicles use3.

Safety issues with Tesla's driver-assist could damage investor’s market confidence.

Tesla's history of missing deadlines on new product launches.

Why does it matter for investors?

Focus on Startups with Advanced AI and Sensor Technologies: look for startups creating innovative AI and sensor technologies that improve self-driving cars' safety and performance.

Consider big companies: established automakers like Volkswagen, Toyota, and General Motors have strong resources for research and development, making them reliable investment choices.

Explore tech partnerships: collaborations between car makers and tech firms, like Uber's investment in Wayve, can speed up the development of autonomous vehicles.

Diversify investments globally: the autonomous vehicle market is growing worldwide, especially in Europe, North America, and Asia. Spreading investments across these regions can reduce risks.

Choose strong performers: companies like Uber are showing solid financial growth and are recommended as strong buys by analysts.

Stay updated on regulations: keep an eye on government rules about self-driving cars, as these will affect market growth. Countries like Germany and Japan are actively supporting this technology.

The launch of Tesla's Cybercab has important implications for retail investors in the autonomous vehicle market. While it aims to transform ride-hailing, safety concerns and unclear plans have shaken confidence, causing Tesla's stock to drop. This uncertainty benefits competitors like Uber and Lyft, whose shares rose after the reveal. For investors, understanding the broader landscape, including regulatory challenges and tech advancements, is crucial. A diversified investment strategy focusing on various companies and technologies will be key to capitalising on future growth in this evolving sector.

https://energynow.com/2024/10/elon-musk-unveils-30000-tesla-cybercab-with-2026-production-but-details-lacking/

https://www.kavout.com/market-lens/teslas-cybercab-robotaxi-unveiling-key-insights-for-investors-and-how-it-stacks-up-against-ubers-autonomous-strategy

https://www.theverge.com/2024/10/10/24265530/tesla-robotaxi-elon-musk-features-range-price-release-date